In the exhilarating and often volatile world of cryptocurrency mining, particularly concerning Bitcoin, optimizing your hardware is paramount. It’s not simply about throwing money at the most expensive mining rig; it’s about strategically selecting equipment that maximizes your return on investment while navigating the ever-shifting landscape of difficulty adjustments and energy costs. This article delves into the nuances of hardware selection strategies for Bitcoin mining, considering factors beyond pure hash rate and exploring the broader ecosystem influencing profitability.

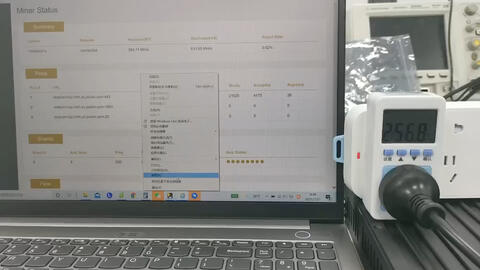

The core of Bitcoin mining revolves around specialized hardware, primarily Application-Specific Integrated Circuits (ASICs). These machines are designed solely for the purpose of solving the complex cryptographic puzzles required to validate Bitcoin transactions and earn block rewards. Choosing the right ASIC miner is the first crucial step. Consider the hash rate (measured in terahashes per second or TH/s), which determines how quickly the miner can perform calculations. Higher hash rates generally translate to a greater chance of solving a block, but also come with higher price tags and power consumption.

Beyond hash rate, energy efficiency is a critical factor often overlooked. Measured in joules per terahash (J/TH), this metric indicates how much energy the miner consumes for each unit of computation. A more energy-efficient miner will translate to lower electricity bills, significantly impacting your overall profitability, especially considering the often-substantial power demands of modern mining operations. Ignoring this metric is akin to fueling a race car with regular gas – you might get it running, but you’re sacrificing performance and efficiency in the long run.

The global distribution of Bitcoin mining farms is also crucial. These massive data centers, often located in regions with cheap electricity (think Iceland or parts of China, Kazakhstan, or even Texas), house vast arrays of mining rigs. The availability of hosting services within these farms allows individuals to participate in Bitcoin mining without the upfront capital expenditure and logistical complexities of managing their own hardware. Hosting agreements typically involve paying a fee for space, electricity, and maintenance, allowing miners to focus on optimizing their mining strategies rather than wrestling with infrastructure.

The broader cryptocurrency market, including altcoins like Dogecoin (DOGE) and Ethereum (ETH), indirectly influences Bitcoin mining strategies. While Bitcoin mining is primarily ASIC-based, other cryptocurrencies, particularly those using Proof-of-Work consensus mechanisms, can be mined using GPUs (Graphics Processing Units). Shifts in the profitability of mining these alternative coins can impact the availability and pricing of GPUs, potentially affecting the overall cost of building or upgrading mining rigs for various cryptocurrencies, including those that might eventually emerge as Bitcoin alternatives or complements.

Furthermore, the fluctuating price of Bitcoin itself dramatically impacts mining profitability. A sudden price surge can make even older, less efficient miners profitable, while a significant price drop can render them obsolete. This inherent volatility necessitates a careful assessment of market trends and forecasts when making hardware investment decisions. Consider the breakeven point – the Bitcoin price at which your mining operation covers its operating costs. Understanding this threshold is vital for managing risk and making informed investment choices.

The role of cryptocurrency exchanges cannot be ignored. These platforms provide the means for miners to convert their Bitcoin rewards into fiat currency or other cryptocurrencies. The ease of access and liquidity offered by exchanges play a crucial role in enabling miners to realize their profits and reinvest in their operations. Furthermore, the fees charged by exchanges and the prevailing exchange rates can significantly impact the overall profitability of mining.

Finally, consider the long-term viability of your hardware investment. ASIC miners have a limited lifespan, eventually becoming less profitable as the Bitcoin network difficulty increases. Factoring in depreciation and planning for future upgrades is essential for maintaining a competitive edge. Exploring strategies like reselling used equipment or repurposing components can help recoup some of the initial investment.

In conclusion, optimizing your Bitcoin mining hardware is a multifaceted endeavor that requires a deep understanding of not only the technical specifications of mining rigs but also the broader economic and market forces at play. By carefully considering hash rate, energy efficiency, electricity costs, market volatility, and the availability of hosting services, miners can develop robust strategies to maximize their profitability and navigate the dynamic world of cryptocurrency mining successfully.

This savvy guide on Bitcoin mining hardware cuts through the noise, blending tech specs, cost hacks, and wildcard strategies—unexpectedly sparking fresh ideas for miners to outpace the competition!