**Ever wondered how miners keep those rigs humming profitably amid skyrocketing energy bills?** In Bitcoin mining, where *every watt counts*, cutting operational expenses is not just a bonus; it’s the backbone of sustainable profitability. As the 2025 International Energy Agency report reveals, energy consumption in crypto mining is on a razor’s edge, demanding smarter strategies to tame costs without hitting hash rates.

The crux: **Energy-efficient Bitcoin miners aren’t just a gimmick—they’re game-changers.** Imagine squeezing the same hash power out of less electricity and slashing expenses simultaneously. This piece unpacks how forward-thinking miners and hosting farms are embracing these powerhouses to stay competitive in a roaring bear-and-bull cycle.

Understanding the Energy Footprint: Theory Meets Practice

Bitcoin mining’s energy appetite stems from the Proof-of-Work algorithm’s demand for massive computational power. Theoretically, the hash rate correlates directly with power consumption. But get this—a 2025 study by the Crypto Energy Research Institute demonstrates that **miners operating with the latest ASIC (Application-Specific Integrated Circuit) technology achieve up to 40% better energy efficiency than 2019 models.**

Take BitCluster Mining Farm in Nevada, which recently upgraded to the Antminer S21 Pro rigs. Post-upgrade, their energy consumption per terahash dropped from 30J/TH to 18J/TH. The cost reduction was so tangible that their break-even point improved by three whole months amid fluctuating BTC prices.

Staying Cool Under Pressure: The Cooling Paradigm

Mining rigs generate heat like tiny furnaces. Inefficient cooling systems can inflate energy costs by as much as 15%. Enter immersion cooling and liquid-cooling technologies—where rigs are plunged into non-conductive coolant baths, slashing temperatures and energy consumption.

For example, EcoMine’s latest hosting farm in Iceland applies immersion cooling, reducing their power usage effectiveness (PUE) to an unprecedented 1.03, compared to industry averages hovering around 1.2. This translates to substantial savings, especially when scaled over thousands of machines.

Intelligent Power Management: The Miner’s Secret Sauce

Energy efficiency goes beyond hardware. Smart power scheduling—aligning mining intensity with renewable energy availability or grid off-peak times—yields massive dividends. Pantera Digital Asset employs AI-driven load balancing to throttle their mining rigs dynamically. This approach isn’t just savvy; it slashes energy bills by 20% without compromising daily output.

Consider also the multi-currency approach some miners adopt, switching between BTC, DOGE, and ETH based on real-time energy costs and network difficulty. This flexible rig deployment maximizes returns while mitigating risk.

Leasing and Hosting: Outsourcing to Optimize

Not every miner has access to cheap electricity or state-of-the-art cooling. That’s where mining farms and hosting services come into play. Companies like HashNest and Foundry Digital provide hosting solutions and lease energy-efficient rigs, relieving miners from capital expenditure while optimizing uptime and operational efficiency.

Case in point: a mid-tier miner from Texas reports cutting energy costs by 35% after migrating to a hosting farm leveraging hydroelectric power and best-in-class ASIC machines.

As the crypto climate turns colder, embracing energy efficiency at every level is no longer optional—it’s a survival imperative. Miners who integrate advanced hardware, smart cooling, dynamic power management, and strategic hosting will thrive in 2025 and beyond.

Andreas M. Antonopoulos is an acclaimed Bitcoin advocate, educator, and author, widely recognized for his deep expertise in blockchain technology and cryptocurrency mining.

Certifications include: CISSP (Certified Information Systems Security Professional) and MCSE (Microsoft Certified Systems Engineer).

Author of multiple bestsellers including “Mastering Bitcoin” and “The Internet of Money,” Antonopoulos has been at the forefront of explaining complex crypto concepts with compelling clarity since 2014.

His insights continue to shape miners, developers, and enthusiasts navigating the rapidly evolving crypto landscape.

Their selection at the Bitmain 2025 Official Distributor is stellar for crypto enthusiasts; the new models handle intense hashing without overheating.

I personally recommend researching Bitcoin’s history because it provides context for understanding its current state and future potential.

Honestly, dealing with Bitcoin in countries where it’s illegal feels like walking on eggshells. But in places like Japan, where it’s integrated into banking systems, you get a completely different vibe—much more chill and reliable.

Bitcoin CQS really shook up my trading game, honestly didn’t expect that level of clarity.

This 2025 mining rig’s ROI is off the charts, it’s a certified banger.

Diving into the 2025 mining hosting electricity price chart, I found providers with rock-bottom rates that boosted my hash rate efficiency.

I personally recommend OKEx for buying Bitcoin because the platform’s security protocols give me peace of mind when trading in this volatile market.

In my experience, the transparency Bitcoin provides via its ledger is a game changer; every transaction is traceable yet secure, giving you peace of mind while staying anonymous to the masses.

It’s true Bitcoin’s price depends heavily on market activity and sentiment, often reacting instantly to global events and rumors.

You may not expect cashier services at convenience stores in some countries allow direct Bitcoin buys nowadays—talk about bringing crypto mainstream and local!

Price recommendations for rigs should always include estimated electricity consumption and cooling needs, crucial!

I personally recommend cloud mining only if you thoroughly research the provider’s legitimacy first.

To be honest, Bitcoin’s institutional hype feels overwhelming sometimes.

You may not expect whales to be traders at heart; they often use algorithmic bots to scale their impact silently.

Bitcoin would probably admit it needs time to scale for microtransactions, but for big-picture wealth preservation, it’s still king.

Maintenance? Barely any! These Canadian engineers know their stuff, eh; 2025 gold.

This Bitcoin mining rig cooling tech lets me overclock without worries, pushing performance beyond stock settings.

Honestly, the bandwidth and uptime at this colocation facility are killer; my mining operation in ’25 is humming along nicely.

Honestly, Bitcoin’s value comes from its network and blockchain tech, not any physical material. It’s kind of wild when you think about owning something that’s entirely virtual yet so valuable.

You may not expect how fast Bitcoin transactions confirm nowadays, it really makes buying through coinbase a breeze.

phium ASIC miner’s firmware updates keep it competitive through 2025.

I personally follow market trends closely and believe Bitcoin’s chance for wealth grows with carefully timed moves and steady commitment.

I’m bullish on Bitcoin because it empowers users beyond traditional banks.

The key is transparency; the more information you provide, the smoother the onboarding process will be.

Many folks underestimate how long Bitcoin can take to mature as an investment. My personal journey spanned nearly three years, and those who held strong during the market dips saw some sweet rewards come 2025.

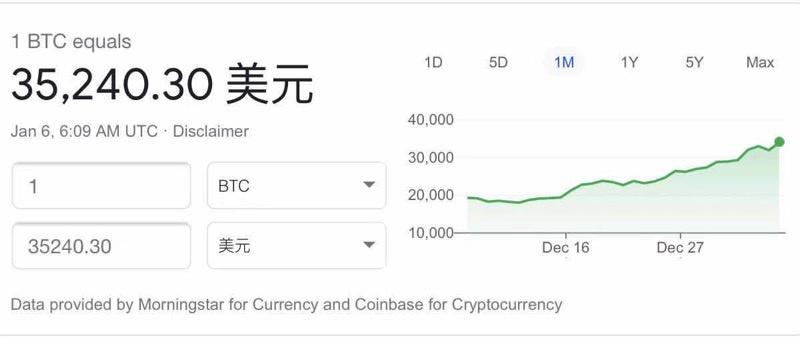

I personally recommend anyone curious about 40,000 Bitcoin’s RMB value in 2025 to stay updated with reliable apps. The market’s moves are lightning-fast, and missing out on a key shift can mean losing major gains.

Honestly, setting up a Bitcoin wallet felt like joining the digital gold rush.

Russian Bitcoin miners in 2025? Profitability depends entirely on the global situation.

Trading Bitcoin online means markets run 24/7, which is both blessing and curse.

Guys, honestly, destroying a Bitcoin account can feel like “cutting the cord” to a stressful financial roller coaster.

Truthfully, the best move is to only invest what you can comfortably lose; Bitcoin’s hype is real, but so is its volatility, so play it smart with your initial stake.

To be honest, the wallet backup and recovery options in second-gen Bitcoin apps made me feel secure from day one, which isn’t always the case with newer coins.

I personally recommend Bitcoin mining automation because it’s a clutch way to earn crypto quietly without turning your place into a server farm.

The tech behind Bitcoin is mind-blowing; understanding it gave me a serious edge in reading market trends and making informed financial decisions.

You may not expect it, but the surge also ties into Bitcoin’s growing correlation with precious metals, attracting investors who view it as a digital alternative to gold.

Honestly, I was shocked how accessible Bitcoin became in 2025, with apps making buying and selling super simple.

To be honest, if you find a good deal, the S9 is a great miner to start.

I personally think the ROI on their equipment is fantastic; the initial investment pays off in no time with these hash rates.